Mortgage originators, servicers, insurers, and investors face a more complex lending environment as 2026 begins. With rising origination volume, ongoing compliance pressure, and shifting borrower risk, Mortgage Investigations help reinforce underwriting decisions and protect investor confidence.

As February approaches, seasonal volume growth can strain internal teams, so independent investigations becomes even more valuable. In addition, a clear investigative process helps risk teams spot issues early and respond before losses grow.

Market and Seasonal Trends Driving Mortgage Investigations in 2026

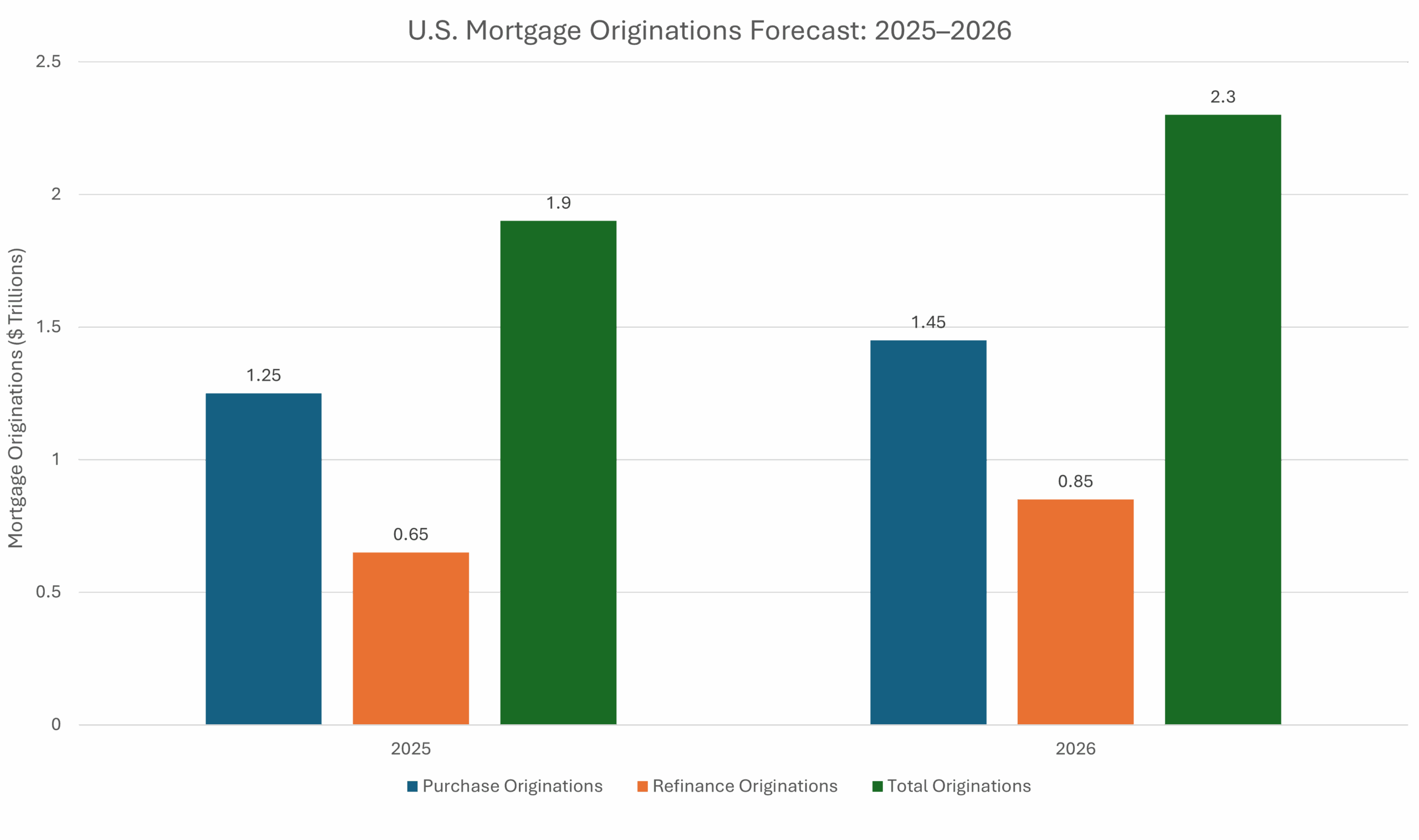

Early 2026 is expected to bring increased activity across the US mortgage market. Lower interest rates and improved housing inventory continue to support both purchase and refinance demand. According to Fannie Mae, home sales may exceed 5 million in 2026, representing nearly a 10% increase over 2025. (Source: businessinsider.com)

With higher loan volume comes higher exposure. The National Mortgage Application Fraud Risk Index reported an 8.2% year over year increase in mortgage fraud risk in 2025, estimating that 1 in 118 applications shows signs of fraud. (Source: cotality.com)

Mortgage Fraud Risk Landscape in Early 2026

Several fraud trends continue to elevate risk for lenders and investors:

• Application fraud increased by approximately 6 to 8% in 2025. (Source: nationalmortgagenews.com)

• Investment and multi-unit properties show higher exposure, with one in 27 applications exhibiting fraud indicators. (Source: cotality.com)

• Undisclosed debt and transaction risk continue to rise, increasing post funding loss potential.

(Source: nationalmortgagenews.com)

These trends reinforce the importance of Mortgage Investigations that extend beyond automated checks.

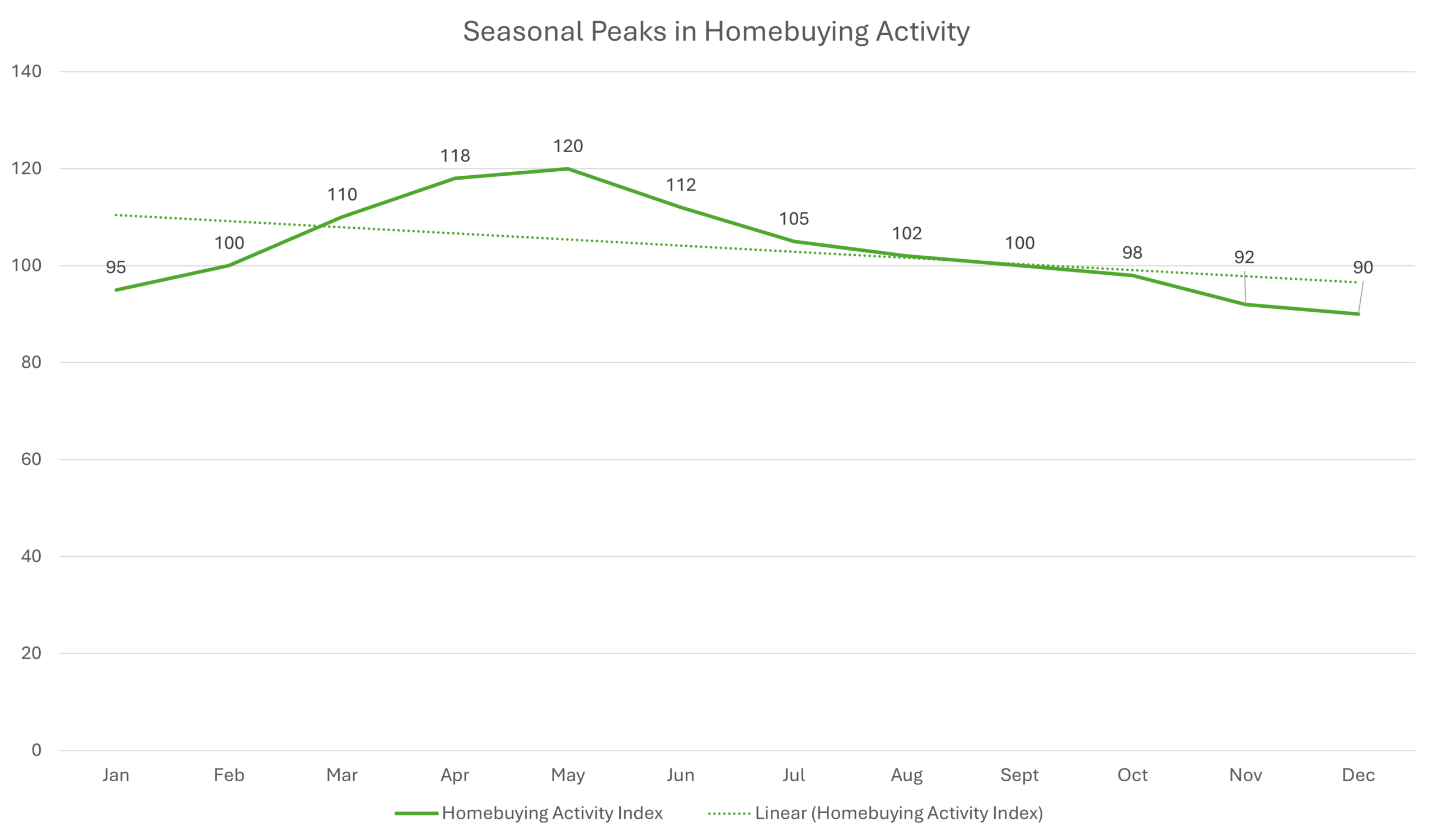

Why February Is a Critical Period for Mortgage Investigations

February and early spring often mark peak origination periods. During these months, higher volume can stretch quality control capacity and slow review timelines. Meanwhile, purchase loans continue to show higher fraud exposure than refinance loans.

Because subtle indicators can appear harmless at first, stronger mortgage investigations helps teams catch risk before funding decisions lock in exposure

Common Pain Points for Mortgage Risk Teams

1. Complex Borrower Behavior

Borrowers may misrepresent income, employment, occupancy, or financial obligations. Independent Mortgage Investigations help validate these details.

2. Compliance and Audit Pressure

Regulators and investors expect complete documentation and defensible underwriting decisions.

3. Operational Strain During Volume Surges

Seasonal volume peaks challenge internal teams and increase review backlogs.

4. Investor Confidence Risk

Incomplete verification increases repurchase exposure and undermines long term investor trust.

How Independent Mortgage Investigations Strengthen Risk Management

Independent, field based Mortgage Investigations add a human verification layer to underwriting and risk review processes.

Evidence Backed Verification

Investigators confirm occupancy, employment, income, assets, and transaction details through direct observation and documented findings.

Audit and Compliance Support

Field verified documentation improves audit readiness and supports regulatory reviews.

Loss Mitigation

Early detection of misrepresentation before funding or shortly after closing reduces buyback exposure and claim denials.

Practical Steps for Risk Teams Using Mortgage Investigations

a. Deploy Independent Verification Early

Integrate Mortgage Investigations before funding so teams can act while options remain available.

b. Focus on High Risk Segments

Investment properties and multi unit loans consistently show higher fraud exposure.

c. Strengthen Compliance Documentation

Use investigation findings to support underwriting defensibility and audit readiness.

d. Maintain a Proactive Review Strategy

Consistent investigative reviews improve quality control across loan portfolios.

Conclusion

As mortgage markets evolve in 2026, protecting investor confidence requires more than automated analytics. Mortgage Investigations provide verified evidence that strengthens underwriting decisions, supports compliance, and safeguards portfolios.

By aligning investigations with seasonal volume trends and elevated risk periods, originators, servicers, insurers, and investors can manage exposure effectively while maintaining efficiency and credibility.

Want to Learn More?

At Frasco, we believe knowledge is the foundation of stronger, smarter lending practices. That’s why we provide resources to help lenders deepen their understanding of risk mitigation and compliance.

📄 Download our white paper:

Unlocking Success: 3 Keys for Maximizing Occupancy Verification in Mortgage Lending

Stay Updated: Get real-time insights, the latest blogs, and updates on upcoming industry events.

👉 Follow Frasco on LinkedIn

Contact Us Today

Frasco® Mortgage Risk Mitigation delivers ethical and efficient solutions tailored to your needs. Have questions or want to discuss your investigative needs further? Schedule a call with one of our experts today to find the answers you’re looking for.

If you know a company that could benefit from our investigative services, Submit a Referral Here to help them make informed decisions and prevent costly risks.

Disclaimer: This blog post is for informational purposes only and should not be considered legal advice. Please consult your general counsel for specific legal guidance. Frasco investigators are licensed, and our operations comply with US industry, federal, state, and local laws.