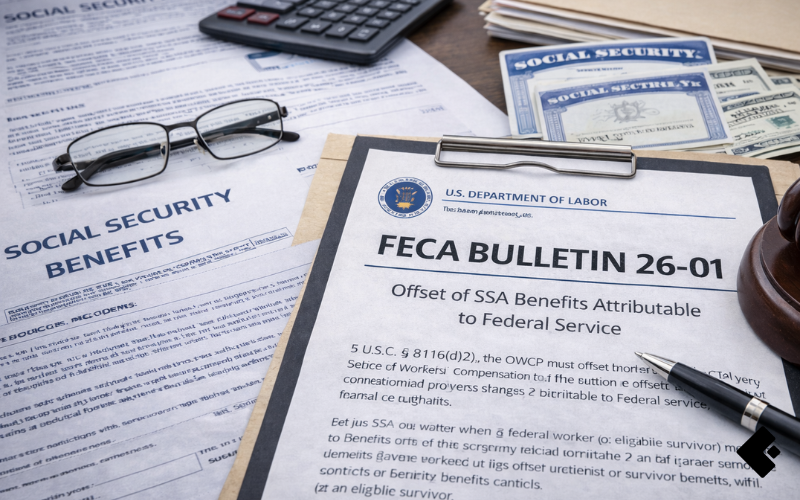

On December 19, 2025, OWCP released FECA Bulletins (2025-2026) | U.S. Department of Labor, which addresses the offset of Social Security Administration benefits attributable to Federal service. FECA Bulletins serve as a temporary method for issuing new or updated procedures, and many later integrate into the OWCP Procedure Manual.

Under 5 U.S.C. § 8116(d)(2), OWCP must reduce FECA disability compensation or death benefits when a claimant or eligible survivor receives SSA retirement or survivor benefits tied to Federal employment. This FECA Bulletin reinforces how and when claims examiners must apply this offset.

What FECA Bulletin No. 26-01 Clarifies

A common misunderstanding suggests that SSA offsets apply only to FERS beneficiaries. However, FECA Bulletin No. 26-01 confirms that the offset applies whenever SSA benefits stem from Federal service, regardless of the retirement system.

As a result, claims examiners must evaluate SSA benefit attribution carefully instead of assuming FERS is the only trigger.

Key Actions for Claims Examiners Under FECA Bulletin No. 26-01

1. Identify the Applicable Retirement System

For claimants age 62 or older, or survivors age 60 or older, claims examiners must confirm retirement coverage. To do this, examiners should review:

-

CA-7 or CA-6 claim forms

-

SF-50 or PS-50 employment records

-

OPM correspondence

-

FERS numbers typically begin with 7 or 8

-

CSRS numbers typically range from 1 to 4

-

-

EN-1032 or CA-12 responses

-

Additional agency or claimant communications

By gathering this information early, examiners reduce delays and ensure accurate application of FECA Bulletin guidance.

2. Determine Whether an SSA Offset Applies

Offsets apply to any retirement system that generated Social Security credits through Federal employment. According to FECA Bulletin No. 26-01, systems requiring review include:

- CSRS Interim/Offset (not traditional CSRS)

-

FERS

-

Foreign Service Retirement System (FSRS)

-

Federal Reserve System (FRS)

-

FICA-associated retirements

-

Tennessee Valley Authority (TVA) Retirement System

When uncertainty exists, claims examiners should contact the Social Security Administration directly to verify whether SSA benefits are attributable to Federal service.

3. Follow Required Development Procedures

Claims examiners must follow standard development steps outlined in PM 2-1000. If SSA confirms that any portion of benefits connects to Federal service, OWCP must apply the offset under § 8116(d)(2) unless the record contains clear, contradictory evidence.

This process ensures consistency, compliance, and defensible claims decisions under the FECA Bulletin framework.

Why FECA Bulletin No. 26-01 Matters

This FECA Bulletin reinforces that SSA offsets extend beyond FERS cases. As Federal retirement systems vary, examiners must verify retirement coverage rather than rely on assumptions. Moreover, consistent application protects program integrity and supports accurate benefit determinations.

Bottom Line for Claims Examiners

FECA Bulletin No. 26-01 confirms that SSA offsets apply whenever Federal service contributes to retirement or survivor benefits, and it is not limited to FERS cases. Therefore, claims examiners must verify retirement systems carefully, coordinate with SSA when needed, and apply offsets consistently to meet statutory requirements.

By following this guidance, examiners ensure fair outcomes, regulatory compliance, and defensible FECA decisions.

Want to Learn more?

Explore how leading government agencies and risk managers are using our investigative services to strengthen oversight of legacy claims.

📄 Download our white paper: FECA Claims Investigations by the Numbers

Stay Updated: Get our latest posts, FECA Trends, and upcoming trainings—right in your feed

👉Follow Frasco on LinkedIn

Contact Us Today

Frasco® Government Services delivers ethical and efficient solutions tailored to your needs. Have questions or want to discuss your investigative needs further?

Schedule a call with Craig DeMello, a nationally recognized expert in Federal Workers’ Compensation. With over 30 years of experience in public service, Craig provides practical insight and proven expertise to help clients navigate complex federal claims. As a Government Services Specialist at Frasco, he is dedicated to delivering clear answers and effective strategies to support your agency’s goals.

Disclaimer: This blog post is for informational purposes only and should not be considered legal advice. Please consult your general counsel for specific legal guidance. Frasco investigators are licensed, and our operations comply with US industry, federal, state, and local laws.