For U.S. insurance carriers, self-insured employers, third-party administrators, and risk management teams, February marks a period of rising Seasonal Claim activity, shifting claim severity, and mounting operational pressure. As claim volumes fluctuate and costs increase across key lines, quality investigations play a critical role in protecting financial performance, maintaining compliance, and supporting defensible claim decisions.

This guide explores Seasonal Claim trends entering 2026, highlights pain points facing claims and SIU teams, and explains how timely investigative services help organizations manage this dynamic risk environment.

Seasonal Claim and Industry Trends Entering Early 2026

1. Workers’ Compensation Severity and Cost Growth

Workers’ compensation continues to show declining claim frequency but increasing severity. In 2024, indemnity and medical lost-time claim severity rose by approximately 5% to 6% compared with the prior year, even as claim frequency declined. Rising medical expenses and longer claim durations drive this trend. (Source: Claims Pages)

Trend Insight: Even with fewer claims overall, the rising cost per Seasonal Claim increases financial exposure for carriers and self-insured employers.

2. Rising Healthcare and Cumulative Trauma Claims

Industry analyses show increasing claim frequency and severity in sectors such as home health and skilled nursing. Lost-time claims rose an estimated 15% to 20% year over year due to workforce expansion, musculoskeletal injuries, and safety challenges. (Source: Skilled Care Journal)

These patterns amplify Seasonal Claim pressure in healthcare-driven industries.

3. Broader Property and Casualty Claim Shifts

Across property and casualty lines, claim patterns continue to evolve. Commercial auto claim volume has expanded significantly in recent years, while personal auto claims have dipped modestly. (Source: Verisk)

This shift changes seasonal claim exposure across multiple lines of business.

4. Fraud and Misrepresentation Risk During High Claim Periods

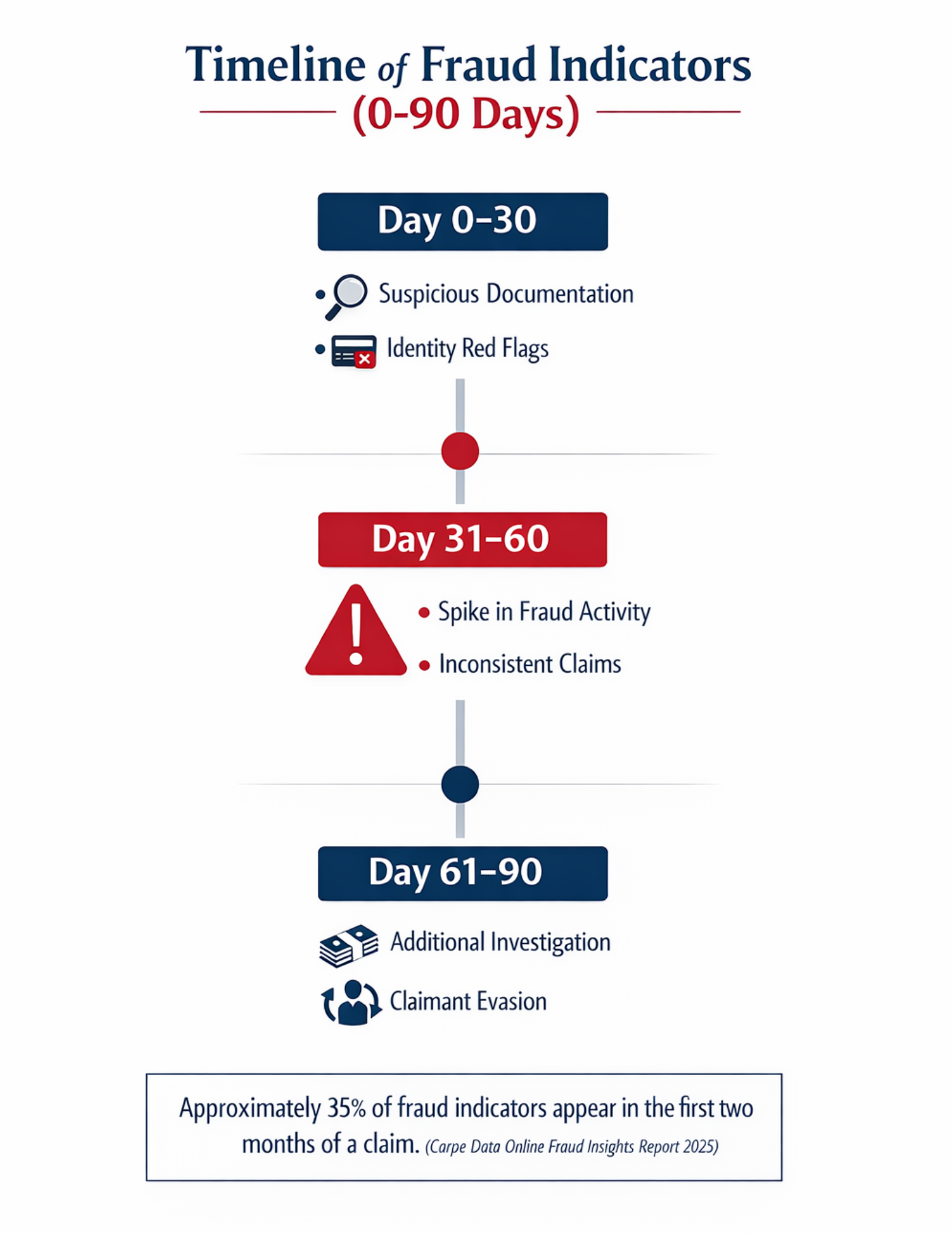

Industry data indicates that 35% of fraud referrals occur within the first two months after a claim is filed, including the winter and early spring window. (Source: Carpe Data)

This timing makes early seasonal claim investigation especially valuable.

5. Fraud Cost Pressures

Workers’ compensation fraud alone costs U.S. insurers an estimated $35 billion to $44 billion annually, making fraud detection a core priority for Seasonal Claim risk management. (Source: Insurance Business)

Why February Matters for Seasonal Claim Operations

February sits at the intersection of:

-

Winter-related seasonal claim activity such as weather losses and slip-and-fall incidents

-

Post-holiday financial stress that can increase opportunistic claims

-

Early-year staffing and workflow adjustments

-

Regulatory, reserving, and audit reviews that accelerate in Q1

Together, these factors create a seasonal claim spike where accurate and timely investigations deliver meaningful value.

Key Seasonal Claim Challenges for Claims and Risk Leaders

Claims professionals and risk managers consistently raise challenges that deepen in February:

1. High Claim Volume vs. Limited Resources

Adjusters and SIU units often encounter backlogs after the year-end and early-year reporting demands. Slow or inconsistent investigations can cost productivity and lead to avoidable payouts.

2. Rising Claim Severity and Cost Pressures

As medical inflation and indemnity costs rise into 2026, carriers must assess Seasonal Claim liability accurately to prevent unnecessary reserve strain. (Source: Insurance Business)

3. Fraud Detection Gaps

Static fraud screening approaches often miss early indicators, particularly during the first 60 to 90 days when fraudulent behavior becomes most visible. (Source: Carpe Data)

4. Compliance and Documentation Expectations

Regulators, auditors, and legal teams increasingly expect thorough investigative documentation to support seasonal claim decisions and litigation defense.

What Motivates Claims, Risk, and SIU Leaders

Survey and market feedback highlights key priorities:

-

Reducing avoidable payouts to protect underwriting results

-

Improving loss ratio visibility through data-driven insights

-

Strengthening efficiency during seasonal claim surges

-

Supporting compliance, transparency, and audit readiness

-

Reducing fraud-related losses and reputational exposure

Integrating these priorities into investigative workflows strengthens both claim outcomes and organizational performance.

How Timely Seasonal Claim Investigations Improve Outcomes

1. Early Identification of High-Risk Claims

A disproportionate share of fraud indicators appears within the first 60 days of a claim.

(Source: Carpe Data )Targeted investigations, including surveillance and out-of-scope research, surface conflicting evidence, helping adjusters make confident early decisions.

2. Cost Containment Through Evidence-Based Decisions

As seasonal claim severity increases with medical and indemnity growth, timely investigations reduce unnecessary indemnity exposure by supporting accurate liability and severity assessments.

3. Operational Resilience in Peak Periods

During seasonal spikes, third-party investigative support allows internal teams to focus on adjudication and customer service rather than extended fieldwork.

Best Practices for Integrating Investigations in Q1 Workflows

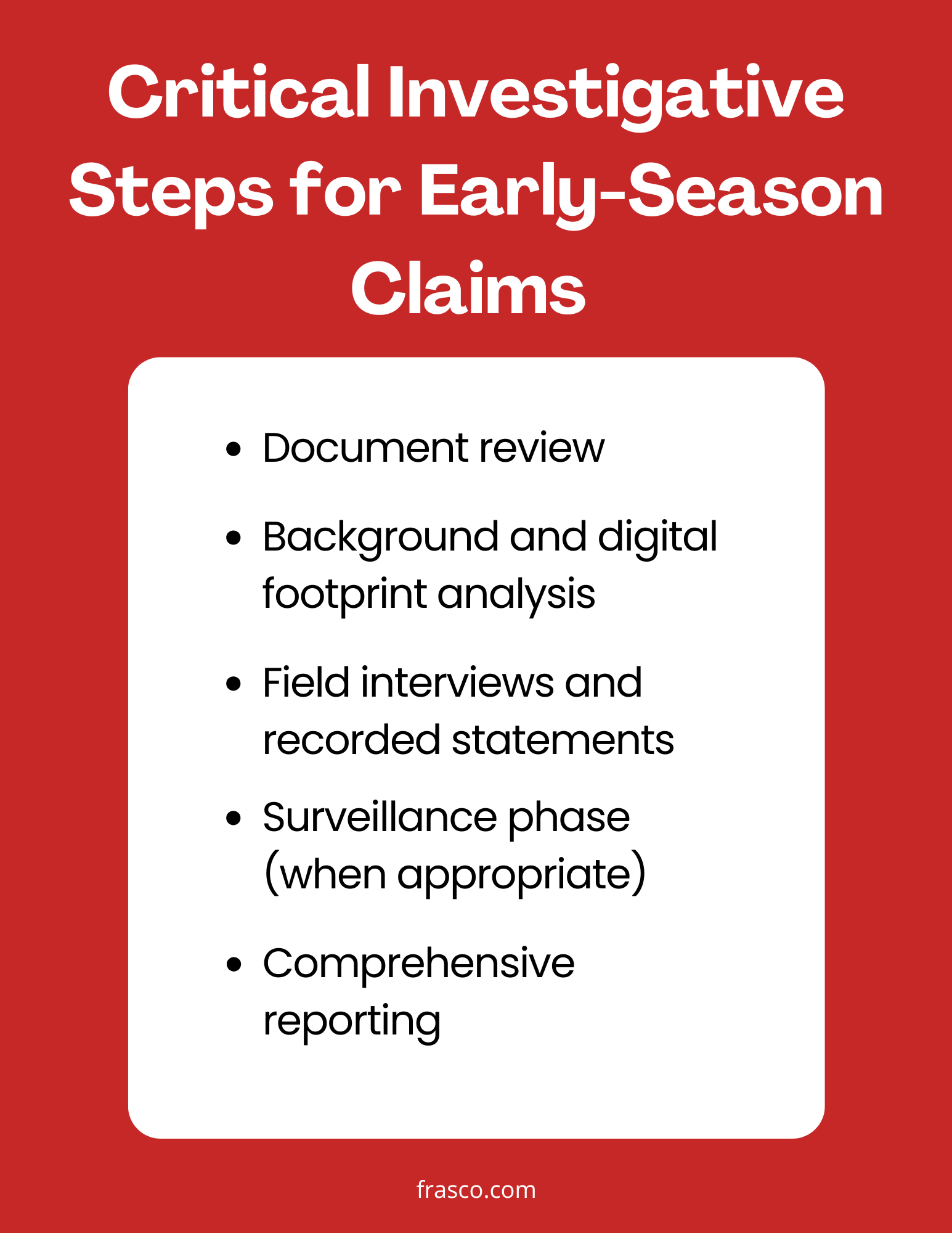

Standardize Claim Triage Protocols

Trigger investigations based on risk signals such as inconsistent physical activity, social media evidence, return-to-work discrepancies, or multiple claim flags.

Align Investigations with Adjuster Workflows

Early coordination between claims teams and SIU units ensures investigators capture evidence while it remains fresh.

Adapt Strategies by Line of Business

Different lines present different risks. For example, workers’ comp has different core severity drivers than commercial auto or homeowners, requiring tailored investigative approaches.

Conclusion

Seasonal Claim spikes in early Q1 increase both the volume and complexity of claims activity. Against rising severity, shifting workforce patterns, and persistent fraud risk, organizations that embed fast, thorough investigation strategies strengthen defensibility, improve operational efficiency, and protect financial performance.

By prioritizing high-quality claims investigations, insurance carriers, TPAs, and self-insured employers can make more confident decisions, reduce losses, and maintain stronger long-term claim outcomes.

Contact Us Today

Frasco® Investigative Services delivers ethical and efficient solutions tailored to your needs. Have questions or want to discuss your investigative needs further? Contact one of our experienced experts today to find the answers you’re looking for.

Disclaimer: This blog post is for informational purposes only and should not be considered legal advice. Please consult your general counsel for specific legal guidance. Frasco investigators are licensed, and our operations comply with US industry, federal, state, and local laws.